How Can You Assure Transactional VAT In Your IT System?

August 27,2019 / ISMCO / Software Blogs

There is a probablity that the FTA may ask you to undertake an audit. At the centre of the first stage during the remotely managed process, the FTA will focus on the veracity of transactions in your IT application.

Best practice recommends your finance should set up relevant tax codes and reporting enhancements in your IT system, train your AR & AP teams and implement governance processes to manage your operations processes.

Ideally your IT system is the single source of truth for your transactional VAT treatment and reporting. Nevertheless, most enterprises are faced with accuracy challenges where human decision making is required to define transactional tax treatment.

For large enterprises with large volume of transactions this can be a larger issue. In this blog we discuss the issues and implications for enterprises for maintaining transactional integrity to support accurate returns and show credibility under an FTA audit.

1. Batch Reviewing is Complete

As a finance professional managing your business’s financial reporting deadlines, adding VAT responsibilities is an added complication that can stretch your team’s capabilities and resources.

Under these pressures, it is usual to focus on the areas which represent the most probable risk areas and sample test accurate tax postings prior to conducting your return calculations. This can be a time-consuming process requiring VAT transactional analysis for each posting.

If your enterprise generates a high volume of transactions, the greater the risks as you may not have time or resources to check every posting. Therefore, batch-based review approaches build inherent risks that may be uncovered during audits.

2. Offline reporting is a risk

Under the premise your IT system is the credible source of transactional accuracy, exporting your data and undertaking your VAT calculations offline has inherent risks and issues.

Offline calculation may be an expedient solution if your reporting solution is less functional, however there are clear and obvious issues. It can be challenging to:

- reconcile to source transactions from excel workings

- assure sufficient time and resource while your understanding is fresh to ensure your return agrees with your internal data

Therefore, offline report calculations can compound the transactional accuracy in your IT application and create further stress on internal resources.

3. Quality & Speed Matters

For any enterprise, the goal is ensuring transactional level tax treatment is accurate in your IT application at source. To fully assess the quality of your enterprise VAT model, you should seek to ask a few salient questions:

- Are all transactions accurately allocated for tax treatment?

- Can this be relied upon to generate an accurate tax report from your IT system?

- Is the VAT model operating at the lowest cost of ownership?

- Can we satisfy responding to FTA queries confidently and responsively to demonstrate credibility?

To answer these questions, your business should assess additional capabilities and tools to address these questions satisfactorily. By taking this approach, you could also improve the efficiency in your finance team and processes. So, what options could you consider?

4. Options To Consider

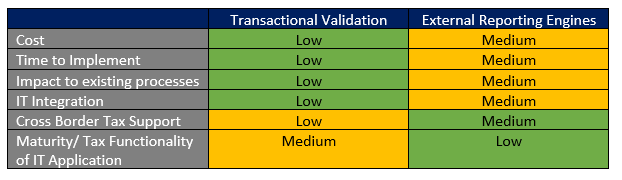

From an IT tools standpoint to achieve greater accuracy for transactional coding, your business may be presented with two broad approaches:

- An external reporting engine to control your VAT reporting model integrated to your IT application

If your enterprise has sufficient IT expertise and budget, you could invest in an external compliance and reporting platform. This option requires careful consideration to the sustainability and timescale for deploying a solution when integrating two separate IT systems.

- Or transactional validation tool to analyse your accounting entries in your IT system and identify errors for correction in source data

The validation approach is a cost effective and easy to deploy solution which relies on your internal IT having the necessary reporting functionality. This is the fastest and simplest option which will incur the smallest impact to your finance and IT functions.

Below represent high level qualitative benefits to either approach:

To manage your VAT obligations, deliver accurate VAT filings and support a credible response to FTA, your IT system and supporting transactional postings are a critical component to achieving these goals.

For finance teams to verify accuracy for postings particularly on AP entries is an onerous task if undertaken manually for large volumes of transactions. Therefore, complementing your process with additional tools can make the difference to improve data quality and internal efficiency in your VAT reporting cycle.

if your business is seeking to improve in your VAT model and systems, we have the platforms and capabilities to support you. Our solutions are state of the art, designed to the UAE legislation and support your finance processes with minimal impacts.

Read About The Validation Service

About ISM

We know the challenges your business faces when operating cost effective, compliant, and efficient enterprise processes. At ISM, we have invested in the best business workflows and IT methodology and standards.

Our approach and solutions automate internal operations to deliver superior efficiency, improve customer and revenue processes to drive growth while providing operational transparency and insight.

Our solutions are specially designed to meet the country regulations and put you in control of your information help you make better business decisions.

Your business can rely on ISM as a partner that focuses on quality-driven delivery, managing risks and continually innovate to deliver superior solutions.

Schedule a no obligation consultation with us today! See how we could transform your enterprise to the next level of productivity and performance. Contact us at +971 43445338 for more information.

Subscribe To Mailing List

How can you assure Transactional VAT in your IT system?