Economic Substance Regulations UAE Guidance Issued

Sept 22,2019 / Haroon Juma /Accounting Blogs

Substance Regulations Guidance Issued

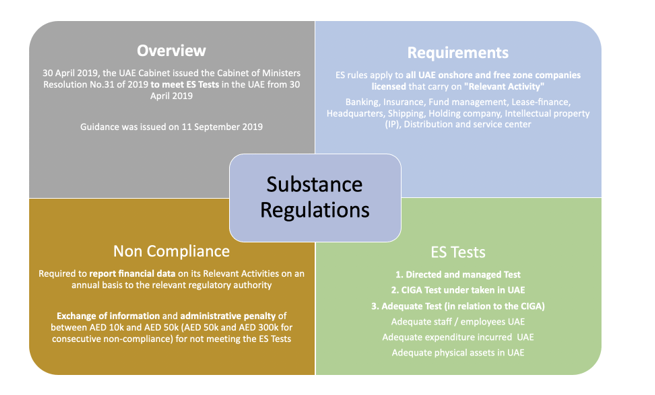

Overview

As of 30th April 2019, The UAE Cabinet introduced economic substance (“ES”) rules. Further guidance (Ministerial Decision No 215 For The Year 2019 On The Issuance Of Directives For The Implementation Provisions For The Cabinet Decision No (31) of 2019 Concerning Economic Substance Requirements) was released on 11 September which provides further elaboration on the requirements for any entity that meets the definition for a relevant activity.

Our previous communication discussed the provisions from the first published ES rules. The second formal issued guidance provides further details on the implementation and requirements for affected entities. This communication provides further details on this issuance on Economic c substance regulations UAE rules affecting the ES Tests. However, it should not be considered exhaustive or final. It may be subject to further revisions or expansion in due course.

The ES rules can be summarised as:

1. Directed and managed Test

The requirement relates to a certain number of directors being physically present in the country, board meetings in the country, making of strategic decisions and records of written minutes signed by the directors attending the meetings.

Board Meetings

The Economic substance regulations UAE rules requires the Board meets in the UAE at an adequate frequency to the amount of decision making required at the level relevant to the relevant activity. The frequency is dependent on the nature, scale and complexity of the relevant activity.

For companies with a minimal level of activity, one meeting held in the UAE should likely be sufficient as clarified in the Guidance.

Branches conducting a Relevant Activity

Generally, the Relevant Activity needs to be directed and managed in the respective country and not the legal entity hosted in another jurisdiction. Key decisions related to the Relevant Activity conducted through the branch must be taken in the UAE.

The Guidance clarifies where the entity is managed by an individual, the directed and managed test will a apply to such individual who could be a designated and authorised manager.

2. Core income generating activities (CIGAs)

Under the test, the CIGAs must be performed in the UAE.

The definition of the CIGAs is non-exclusive in the Guidance and what defines the CIGAs can vary from business to business.

The ES rules in principle allow that CIGAs can be outsourced subject to conditions. CIGAs can be outsourced to service providers in the UAE if there is sufficient oversight over the service provider.

Back office functions maybe subject to a CIGA depending on the business model. If the back-office function is affecting and benefiting the company internally Relevant Activity, it may not be part of a CIGA and does not necessarily need to be performed in the UAE.

If the entity is a group support company providing services to other group entities, then it would be a CIGA which would have to be performed in the UAE.

3. Adequate Test

This test requires the company to have an adequate number of qualified employees in the UAE, adequate expenditure incurred in the UAE and adequate physical assets in UAE.

What is considered “adequate” is dependent on several factors including the nature, scale and complexity of the business.

Under the Adequate Test, an entity is not required to incur more expenditure or engage more employees than it really needs if it is carrying on the Relevant Activity/CIGA. Therefore, an entity needs should not unduly rely on expenditure incurred or employees based outside the UAE to carry out the CIGA in the UAE.

The Guidance also clarifies that under certain conditions, CIGAs can be undertaken by the board of directors (in addition to their legal duties as directors) to reduce/eliminate the need for employees.

4. Compliance, reporting & penalties

Any companies subject to Economic substance regulations UAE will be compelled to the following two compliance/reporting requirements:

- Notification

- Report submission.

Notification

Businesses are required to notify the relevant regulatory authority, typically the license issuing authority, on the following:

- Whether it carries out a Relevant Activity;

- If so, if all or part of the gross income in relation to the Relevant Activity is subject to tax outside the UAE

- The date of its financial year end (“FYE”).

Economic Substance Report

An affected business is required to satisfy the Economic substance regulations UAE test and submit a report to the regulatory authority. This report generally contains information on the following:

- Type of the Relevant Activity performed

- Amount and type of income generated in relation to the RA

- Location of business and if applicable, plant, property and equipment used for the relevant activity in the UAE

- Number of full-time employees with qualifications

- Information regarding CIGAs

- Declaration whether the Economic Substance Test is met

- Further information in case of a high-risk IP business; and

- Further information if the relevant activity is outsourced (e.g. demonstrating that the outsourced relevant activity is carried out in the UAE, the Licensee exercises adequate supervision of the relevant activity, and that the level of resources employed by the third party service provider are adequate in relation to the level of the relevant activity outsourced).

Deadlines and format

The timing/deadline and form of the notification have not been defined as yet.

According to the rules, the ES report needs to be prepared and submitted within twelve months following the Financial Year End of the company.

Implications of ES test non compliance

If the regulatory authority assesses that the above ES tests have not been met for a financial period, it will issue a notice to the company

- covering the reasons for such determination,

- the amount of applicable penalty,

- the payment due date,

- the recommended action to be taken by the company,

- and the right to appeal.

A financial penalty beginning from AED 10,000 and up to AED 50,000 would be imposed for the first year of non-compliance. Subsequent instances of non-compliance may attract a penalty of up to AED 300,000. Failure to provide information or inaccurate information would also attract penalties ranging from AED 10,000 and up to AED 50,000.

In addition, the regulatory authority also has the power impose administrative action including the suspension, revocation or non-renewal of the license of the licensee in case of consecutive non-compliance.

If the relevant entity does not comply to the ES tests, the MOF will notify the foreign competent authority of the parent company, country of ultimate parent company and the ultimate beneficial owners of the relevant company.

Partner With SimplySolved

Serving over 200+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations in Finance, Tax, Human Resources Management, IT and Marketing.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM, IT & Marketing. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the regulations and help you make better business decisions.

Subscribe To Mailing List

Economic Substance Regulation UAE Guidance Issued