Internal Audits – Why They Work?

Dec 23,2020 / Haroon Juma / Auditing Blogs

As a business owner managing all the many aspects of your business is a complex and time-consuming process. It can be difficult to remain fully informed on all the details and it is natural to rely on your company processes, system and people.

However all too often a business will experience occasions where inadequate internal controls and policies affect business performance and present an inaccurate understanding of your business risks.

This can create an opaque and unclear picture of your business’ health; an internal audit can provide clarity to assure your long-term sustainability and reinforce the quality of your processes and controls.

Internal Audit vs External Audit

Internal audits should never be confused with external audit. Although there are few similarities, but the main objectives are quite different.

An external audit is primarily focused on the reliability of internally prepared financial statements for a financial period attested by an approved auditor that conducts an audit to recognized financial standards. This is solely focused on the financial statements and at times an auditor may qualify financial statements to highlight issues that reduce the veracity of the financial statements.

This naturally will not take a deeper look at internal processes, controls and risks which may affect the business performance and strength of operation and financial processes. This is where an internal audit comes into greater focus.

In large companies this is normally and “throughout the year” process managed by a dedicated internal function. In smaller businesses, a qualified external auditor will bring to bear proven methodology and skills to provide insight and identify risks for management attention.

What is Internal Audit?

Internal Audit is concerned with evaluating and improving the effectiveness of risk management, control and governance processes in the organization.

In simple, the main purpose of an internal audit function is to make assure that the financial, operational and strategic profile of the organization adhere to the achievement of the objectives for which the organization has been established. The internal audit function also advises on how to streamline processes to make them efficient and risk free.

What Should You Consider?

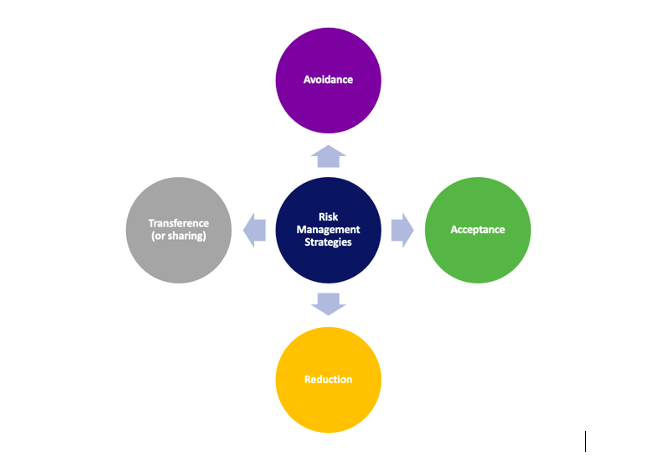

If your business is seeking external expertise, a qualified auditor with a proven methodology such as TARA (Transference Avoidance, Reduction or Acceptance) for managing risks should be applied.

They should identify risks to the implementation of the policies established by an organization and identify any loopholes in those policies. Generally, an auditor looks closely the way operations are carried out in an organization and notes down the procedures and matches it with the policy made by the organization.

If the auditor witnesses something that is not carried out in accordance with the policies, they will mark it against his quality control review checklist and look for reasons why the organization deviates from documented policy.

There might be cases where the documented policy no longer works well. If this is the case, the deviation is “all good” provided it helps more in achieving required objectives. In such a case the auditor will recommend updating the policy document. The auditor may also contribute to further improve the newly adopted procedures.

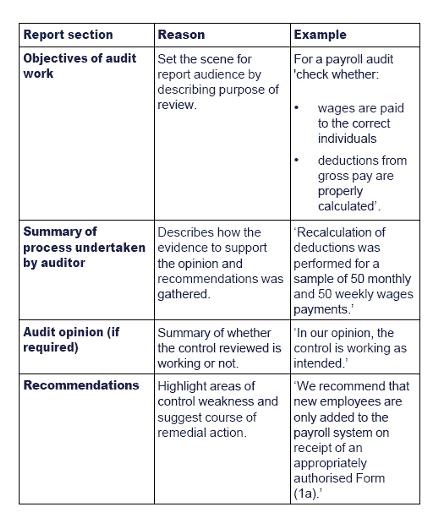

Once an internal control audit (or any other kind of audit) has been completed, the final stage of the assignment is the audit report.

The audit report does not have a prescribed format; however, it would be expected to feature several different parts.

How much depth the report goes into will depend on the nature of the engagement.

When making recommendations auditors must always ensure that the recommendations:

- are practical and cost effective, and

- will reduce risk to a tolerable level.

The auditor should have a process of post-implementation review to ensure that recommendations have been actioned by management.

Benefits of Internal Audit

There are numerous benefits of internal audit. The most important is the smooth compliance with the top management’s policies due to proper monitoring of the processes.

Monitoring process will ensure security of the “money profile” of an organization in numerous ways. For example, if the organization’s policy is to revalue an asset after getting proper bids but does not do so, there is high risk that the asset has an inaccurate effect on the financial reports and may undervalue assets which affects the ability to raise capital.

Another very important benefit of internal audits is that it ensures positive external audits as well. This is because internal functions already ensure that the organization follows all the policies in place and alters them, if needed, for improvements to get the best possible results.

This plays a vital role in a clear audit report because when effective controls are in place, external auditor will rely on them and avoid substantive procedures.

If your business wants to assess and improve its internal controls and processes, we deliver to quality processes and robust methodologies to provide insightful and practical guidance.

As a certified ISO 9001 Quality & 27001 Information Security firm and approved FTA Tax Agency, we deliver to standards your business can rely on across a range of services from advisory, outsourcing and IT project delivery. Contact us to speak to our consultants :

Call us at 043445338 or Visit us at www.simplysolved.ae

Partner With SimplySolved

Serving over 200+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations in Finance, Tax, Human Resources Management, IT and Marketing.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM, IT & Marketing. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the regulations and help you make better business decisions.

Subscribe To Mailing List

Internal Audits – Why They Work